tax on forex trading in india

In this community you will find out every single things about forex like forex broker reviews forex trading style word. Unlike the stock market which has opening and closing times the forex market.

Top 6 Countries For A Forex Trader Easy Trade

Binary options and Cfd trader and when I started this blog I couldnt find a single review about many binary options services.

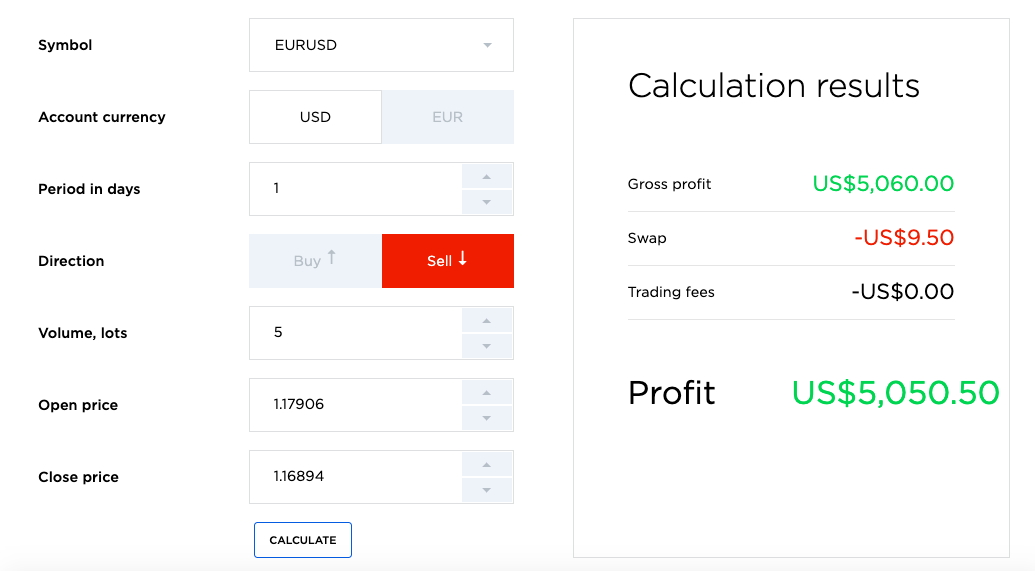

. Checkout this Video to know about Income Tax Return Filing For Forex Trading or Income How to Pay Tax on Forex Income in IndiaHow To Pay Tax on Forex Incom. The tax amount is 18 of the taxable value. This is so as to avoid Interest under Section 234B and 234C.

ITR Form ITR-3 For individuals and HUFs having Income. Therefore the total amount which should be paid in taxes will be 30000 x 022 which is 6600. The amount they are earning is offered fro tax at full rate ie.

The term Forex Currencies Trading is a core concept under trading. Forex Trading in India. 3334 and accordingly they can claim it as their genuine income source.

Currency trading is also known as forex trading takes place on foreign exchange markets. As per section 206C 1G of the Income-tax Act 1961 Forex transactions are liable to tax if the amount exceeds a specific limit. When trading futures or options investors are effectively taxed at the maximum long-term capital gains rate or 20 on 60 of the gains or losses and the maximum short.

How to pay tax on forex income generated from Indian broker or foreign broker in IndiaForexTrading forex trading IndiaForex BrokersI use bel. I lost lots of. On the other hand if they decide to file their trading earnings under section.

Posted by 2 hours ago. 10000 then they must calculate and pay Advance Tax. Tax on cryptocurrencies in India.

The most common way to trade forex is through a foreign exchange trading platform. It is legal to carry out Forex trading in India but it should be practiced strictly through the forex trading platform. In other words 60 of gains or losses are.

The exchange of foreign currencies in India is legal and the answer to the question is forex trading illegal in India is a No. Tax Implications on Forex Transactions. Get to know the definition of Forex Currencies Trading what it is the advantages and the latest trends.

Forex trading in India cannot be done at any land-based location as the only online forex trading is available. Greater than Rs 10 Lakh. The most common way to trade forex is through a foreign exchange trading platform.

In simple terms you can only carry out a. Income from FO Trading is classified as Non-Speculative Business Income for preparation of Income Tax Return. Investors are often under the impression whether is.

For tax purposes forex options and futures contracts are considered IRC section 1256 contracts which are subject to a 6040 tax consideration. Tax On Forex Trading In India. Currency trading is also known as forex trading takes place on foreign exchange markets.

If the tax liability of the trader is expected to exceed Rs. So I decided to make one. The taxable value of transactions of more than Rs 10 Lakh is Rs 5500 01 of the transaction amount.

Mastering Forex Trading Psychology

Trading Taxes In India How Trading Profit Is Taxed By Irs

What You Need To Know If You Want To Trade Forex In India

Do You Recommend Forex Trading What Are The Pros And Cons I M New Quora

Legality Of Forex Trading In India Ipleaders

Best 10 Rbi Approved And Sebi Regulated Forex Brokers In India 2022

What Is Forex Trading Forbes Advisor

/dotdash_Final_Why_the_Forex_Market_Is_Open_24_Hours_a_Day_Sep_2020-01-d2b1c5295a0b4d7a8df8eb057505efb3.jpg)

Why Is The Forex Market Open 24 Hours A Day

Which Countries Ban Forex Trading Forex Academy

:max_bytes(150000):strip_icc()/dotdash_INV_final-Where-Is-the-Central-Location-of-the-Forex-Market_Feb_2021-bda66f26d44b4fe59da8e2b2eb425c00.jpg)

Where Is The Central Location Of The Forex Market

Do I Have To Pay Taxes On Forex Income In India Youtube

Forex Trading 2022 How To Trade Forex Beginners Guide

What Does Forex Trading Cost In 2022 Fees Comparison

Forex Market Hours When Is The Best Time Of Day To Trade Forex

What Is Forex Trading And How To Trade Forex In India

How To Do Forex Trading In India

/dotdash_Final_Why_the_Forex_Market_Is_Open_24_Hours_a_Day_Sep_2020-01-d2b1c5295a0b4d7a8df8eb057505efb3.jpg)

Why Is The Forex Market Open 24 Hours A Day

Forex Trading Academy Best Educational Provider Axiory Global